Opinion: The 5p Tax Rise Is Being Soft-Launched

By Fidelis News – Editorial Desk

This week, headlines across the political spectrum have echoed a shared refrain: the UK faces a black hole in its public finances, and a 5p rise in income tax is now openly discussed as a way to fill it. But let’s be clear—this isn’t just a policy floated by a think tank. It feels more like a strategic leak to test the public’s pain threshold.

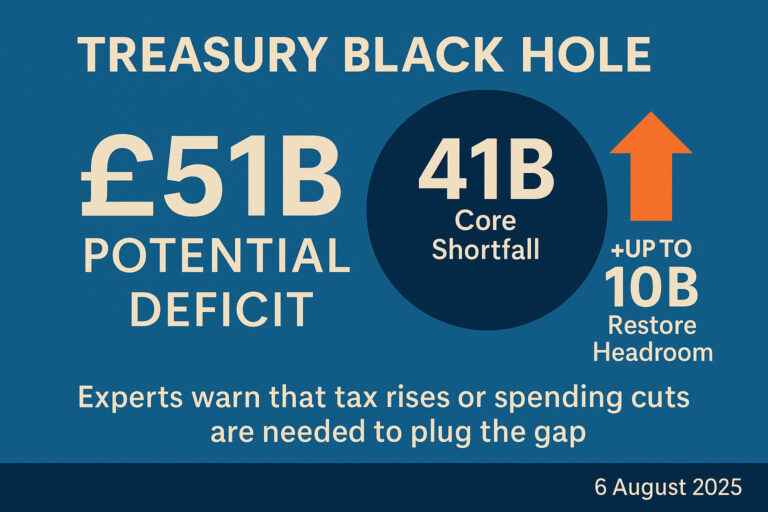

The National Institute of Economic and Social Research (NIESR) proposed raising both the basic and higher rates of income tax by 5 percentage points—enough to generate the revenue needed to plug a projected £51 billion gap. On paper, it’s just one solution among many. In practice, it’s being paraded across the media with remarkable consistency.

The Guardian called the rise “moderate but sustained.” The Telegraph said it’s the scale required to fix the books. The Sun warned about middle-class burden. The Times highlighted that Starmer refused to rule it out.

This kind of pattern is familiar. It’s what political strategists call a “trial balloon.” Float the worst-case scenario via independent analysts and media coverage. Gauge the public backlash. Then either scale it back or quietly make it policy once the public’s been desensitised. It’s not manipulation—it’s just politics. But that doesn’t mean we shouldn’t call it out.

The issue here isn’t just tax policy. It’s the way governments avoid accountability. Starmer campaigned on not raising income tax, VAT, or NI. Now, the vague answers and silence around those pledges raise flags. If the rise was off the table, they’d say so. They haven’t.

Whether or not the 5p hike lands in the Autumn Budget, its presence in headlines already serves a purpose: to reframe what was once unthinkable as now inevitable.

Further reading:

– FT: Rachel Reeves faces £51bn black hole

– Live UK politics updates

– Insurance Business: Big tax hit forecast

Fidelis News is free to read – but not free to make.

Support our work via Buy Me a Coffee.