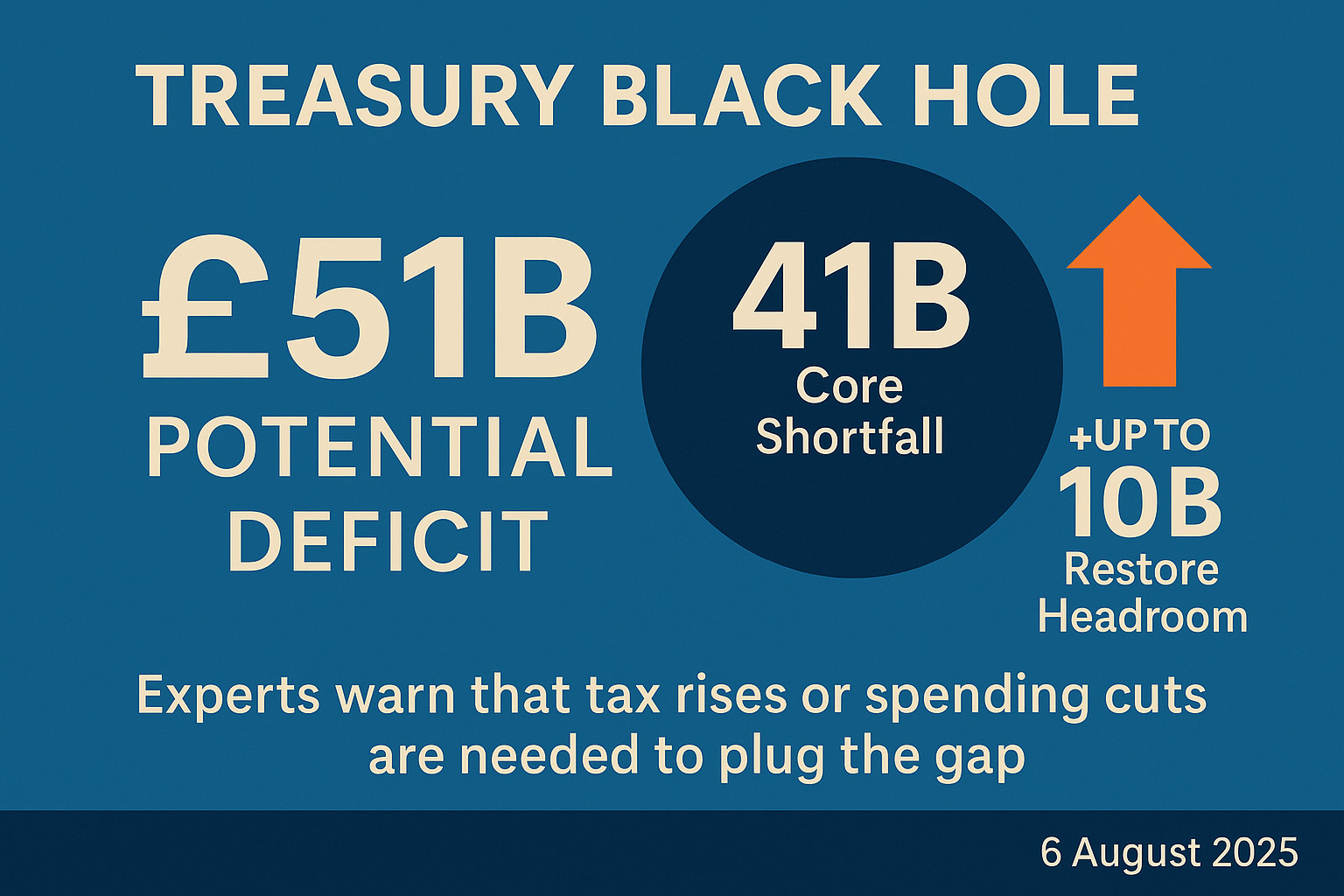

UK Faces Treasury Black Hole of Up to 51 Billion Ahead of Autumn Budget

6 August 2025 – London: The UK Treasury may be facing a fiscal shortfall of up to 51 billion pounds, according to new analysis by the National Institute of Economic and Social Research (NIESR). The report warns that Chancellor Rachel Reeves will need to raise taxes, cut spending, or both in the Autumn Budget to restore financial headroom and meet existing fiscal rules.

Scope of the Gap

The core funding gap stands at approximately 41.2 billion pounds. However, if the government wishes to rebuild the fiscal buffer previously maintained under Conservative leadership, the required figure rises to 51 billion pounds.

“It is the tightest fiscal inheritance in modern history,” said Professor Stephen Millard, Deputy Director at NIESR. “The headroom left for any new Chancellor is almost non-existent.”

Economic Factors Driving the Shortfall

The Institute cited weaker-than-expected economic growth, increased debt servicing costs due to inflation, and recent policy reversals as contributing factors. NIESR revised the UK’s 2025 GDP growth forecast down to just 1 percent, significantly below expectations at the start of the year.

Higher interest rates over the past two years have also increased the cost of servicing government debt. The recent reversal of several planned welfare reforms has further reduced expected savings.

Policy Options on the Table

Chancellor Reeves has stated publicly that she will avoid raising income tax, VAT, or National Insurance. However, economists believe the government may extend the current income tax threshold freeze, which acts as a “stealth tax” by bringing more people into higher tax brackets through wage inflation.

Other options being debated include narrowing pension tax relief, reforming capital gains tax, and introducing new levies on wealth. While the Labour Party has avoided explicit proposals for a wealth tax, pressure from within its own ranks has grown.

“Fiscal choices now require either higher taxation or constrained spending. There is no painless path forward,” said Carl Emmerson of the Institute for Fiscal Studies (IFS).

Political Response

Prime Minister Keir Starmer has not ruled out additional tax increases. Speaking last week, he said: “We will always be honest with the British people about the choices we face. But we are determined to grow the economy and restore public services.”

Opposition parties have criticized the government for lacking a clear plan. Reform UK leader Nigel Farage said, “This is what happens when you make spending promises you cannot fund.”

Public Finance Context

The shortfall is not unprecedented, but the lack of fiscal headroom creates a challenge for long-term investment and economic credibility. Reeves has maintained that the government will operate under the same fiscal rules used by her predecessors, limiting borrowing to fund only capital investment, not day-to-day spending.

Markets are watching closely. Any significant deviation from fiscal discipline could trigger higher borrowing costs and reduce investor confidence, particularly in a volatile global climate.

Summary and Outlook

With limited room to maneuver, the government will need to make difficult choices in the months ahead. The Autumn Budget is expected to contain both tax and spending decisions that could define the direction of the economy for the next five years.

Fidelis News is free to read – but not free to make.

If you value independent reporting, you can support our work via Buy Me a Coffee.