US Tariff Uncertainty Slows Asia’s Factory Output in July

US Tariff Uncertainty Slows Asia’s Factory Output in July

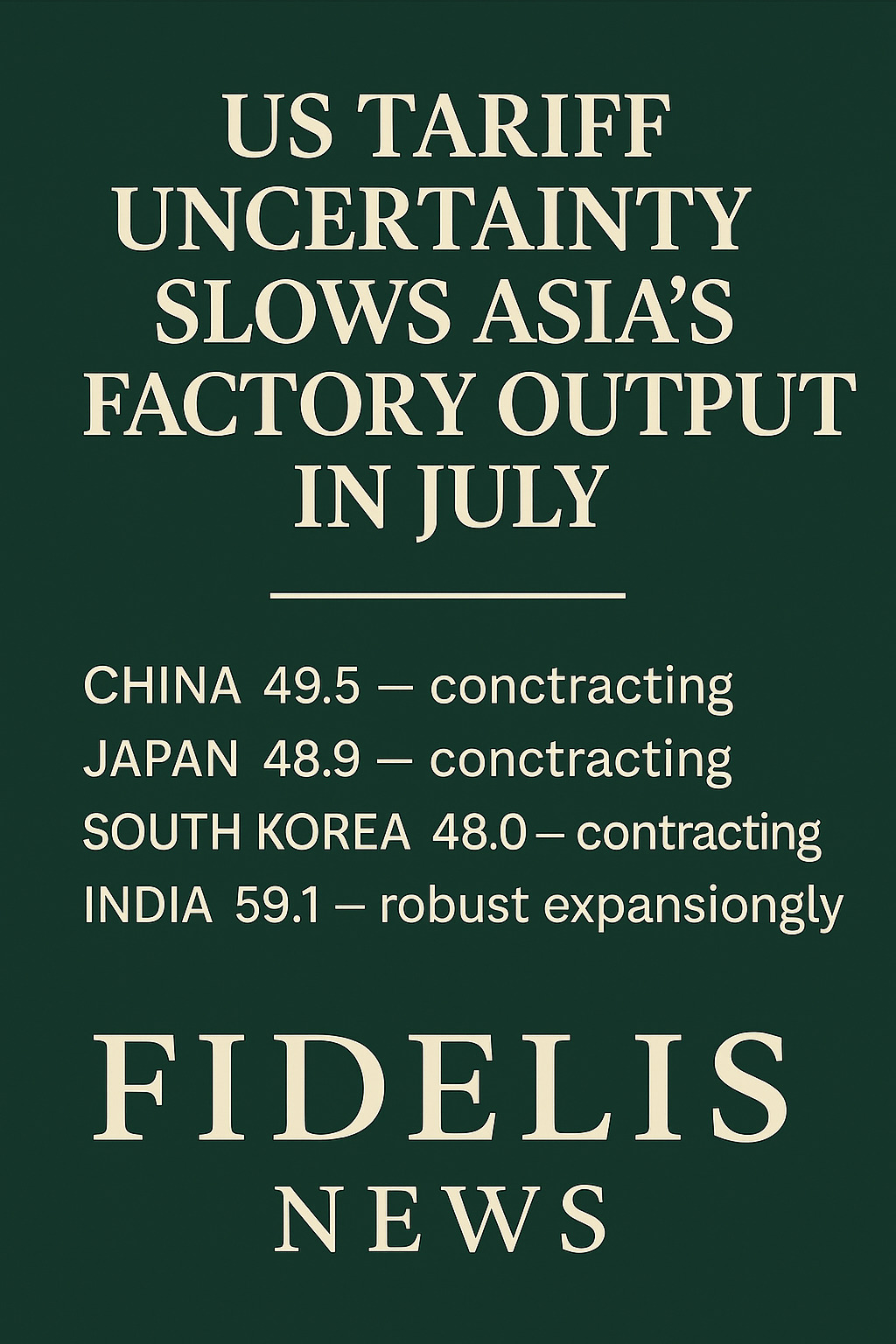

Asia’s manufacturing sector took a hit in July, with fresh economic data pointing to widespread slowdowns tied to U.S. trade tensions. The latest Purchasing Managers’ Index (PMI) figures reveal that industrial output in several major Asian economies contracted last month, with concerns mounting over the future of global demand and American tariff policy.

China recorded a PMI of 49.5, Japan came in at 48.9, and South Korea at 48.0—all below the neutral 50 threshold, indicating industrial contraction. These figures reflect reduced production output, declining new orders, and fragile business sentiment.

“Much of the slowdown is a reaction to ongoing U.S. tariffs on key exports and uncertainty over trade rules,” said Hiroshi Watanabe, senior economist at the Tokyo Institute for Global Economics. “Companies are hesitant to expand production without clarity on long-term access to U.S. markets.”

By contrast, India bucked the trend with a PMI of 59.1, marking its fastest manufacturing growth in over 16 months, driven largely by strong domestic demand and relative insulation from U.S. export restrictions.

ASEAN Mixed Results

Across Southeast Asia, PMI readings were mixed. Thailand and Vietnam showed modest growth, while Indonesia, Malaysia, and Taiwan reported sluggish or declining factory activity. Many firms cited reduced foreign orders, input cost inflation, and shipping delays as persistent obstacles.

Recent Trade Shifts

Efforts are underway to ease tensions, with the U.S. having recently concluded new trade discussions with Japan and South Korea, reducing tariffs from 25% to 15% on key imports. However, economists warn that the positive effects of such agreements may not materialise until Q3 or later.

This slowdown adds pressure to an already fragile global supply chain, with inflation, maritime costs, and geopolitical competition in the Indo-Pacific all contributing to rising uncertainty.

🧠 Context: What Is the PMI?

The Purchasing Managers’ Index is a widely watched monthly economic indicator. A PMI reading above 50 indicates expansion, while below 50 signals contraction. It measures new orders, output, employment, supplier delivery times, and inventory levels.

- China: 49.5 – contracting

- Japan: 48.9 – contracting

- South Korea: 48.0 – contracting

- India: 59.1 – expanding strongly

Long-Term Outlook

Experts say the region’s manufacturing outlook depends on two key factors: resolution of U.S. tariff threats and stabilisation of global inflation. Until then, companies are expected to remain cautious with expansion plans, especially in export-heavy industries like electronics, automobiles, and semiconductors.

With trade negotiations ongoing and industrial sentiment low, the Asia-Pacific region faces a delicate economic balancing act in the second half of 2025.

📰 Fidelis is free to read, but not free to produce.

☕ If this coverage matters to you, support us here:

👉 BuyMeACoffee.com/fidelisnews